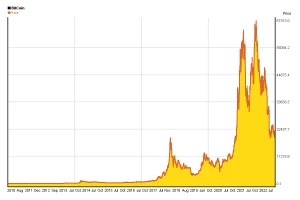

Evolution of Bitcoin between 1998 and 2022 :

If you invested $100 in Bitcoin on Apr 2011, Today(Oct 2022) its worth of $19,000,00 and it’s all-time high values over $68,000,00 in November 2021

Bitcoin is dubbed by most as the king of crypto currencies. That is mainly due to it being the first established crypto. However, between 1998 and 2009, various attempts were made at creating online currencies with ledgers secured by encryption. The two prime examples were B-Money and Bit Gold, which were proposed but never fully developed.

In 2008, a white paper called “Bitcoin: A Peer-to-Peer Electronic Cash System” was emailed to many people by a mysterious person or group of persons named Satoshi Nakamoto. Bitcoin was built on the blockchain, a revolutionary technology invented by cryptographers Scott Stornetta and Stuart Haber in 1991.

In 2009, the Bitcoin software was made public and thus began mining – the process by which new Bitcoins are created, and transactions are recorded and verified. A year later, on 22 May, a guy named Laszlo Hanyecz made history by trading Bitcoin for the first time. He agreed to pay 10,000 BTC for two pizzas in Florida. Admittedly, a day he’ll forever regret. Up until then, Bitcoin had no assigned value.

The first altcoins appeared in 2011 as Bitcoin increased in popularity primarily due to the idea of a decentralised currency that was not controlled or regulated by any government. Despite being the original cryptocurrency, Bitcoin has lagged concerning usability and is not a transactional crypto. Bitcoin is more of a store of value or even a commodity. At the same time, ETN continues to prove it is transactional and, therefore, usable.

Bitcoin is an alternative to fiat currencies, such as the U.S. dollar, that are controlled by governments and central banks. Transactions are verified via a process known as a proof-of-work consensus mechanism. Bitcoin Miners compete to verify transactions by solving complex mathematical functions using powerful computers.

An summary of some significant periods in Bitcoin’s brief history and how they may impact its future may be seen below:

- When did Bitcoin start?

- Bitcoin price history?

When did Bitcoin start?

Bitcoin was born during one of the most chaotic financial environments in U.S. history. During the global financial crisis of 2007 to 2009, distrust of banks and central governments was at a peak.

Bitcoin was created in 2009 by a person or group of people using the pseudonym Satoshi Nakamoto, the name which appeared on the original 2008 Bitcoin white paper that first described the blockchain system that would serve as the backbone of the entire cryptocurrency market.

Over the years, several people have stepped forward claiming to be the real Satoshi Nakamoto, but none could provide sufficient evidence to support their claims.

The Bitcoin blockchain was officially launched when the first Bitcoin block, the genesis block, was created on Jan. 3, 2009. In the first seven months following Bitcoin’s launch, Satoshi reportedly mined up to 1.1 million Bitcoins. At August 2022 prices, those coins would now be worth about $22 billion.

Joshua Peck, founder and chief investment officer of cryptocurrency hedge fund TrueCode Capital, says early Bitcoin enthusiasts were captivated with its design, even if they weren’t exactly certain of what it was going to actually be.

“It had some economic value, but I was looking at it more from an engineering perspective thinking that we could use it for secure message passing or getting strong cryptography into the hands of everyday users, so the financial value was somewhat secondary,” Peck says.

The first reported real-world financial transaction involving Bitcoin took place on May 22, 2010, when a Florida man negotiated to pay 10,000 BTC for two Papa John’s pizzas priced at about $25. That transaction valued the price of one Bitcoin at roughly a fourth of a cent. To this day, the Bitcoin community celebrates Pizza Day on May 22.

“Over time, the financial value became more broadly understood and, of course, today it has become the cornerstone of the fastest-growing asset class of my generation,” Peck says.

Bitcoin Price History?

Bitcoin first became available to buy, sell and trade on online exchanges in 2010. In April 2011, the price of Bitcoin crossed the $1 threshold for the first time.

Bitcoin also faced its first competition in the crypto space in 2011. Litecoin (LTC) was launched in October 2011. The Ethereum blockchain went live several years later in 2015.

As Bitcoin’s price continued to rise, so too did its visibility, popularity and volatility. By November 2013, Bitcoin prices reached $1,000. Bitcoin prices and trading volumes really started to snowball in late 2017 – with prices hitting $10,000 per coin for the first time in November 2017 – and reached about $20,000 in December 2017.

One of the driving forces behind the parabolic rise in Bitcoin prices was an announcement by CME Group Inc. (ticker: CME) that it would be launching Bitcoin futures contracts in December 2017. These contracts represented the first Bitcoin-related financial product offered by a regulated U.S. financial institution.

Jarek Hirniak, founder and CEO of Generation Lambda, says Bitcoin followed a common innovation trajectory known as the Gartner Hype Cycle. According to the model, as a new technology such as Bitcoin gains visibility, expectations initially soar to an unreasonably high level.

“At first, most people ignore it, and then suddenly everyone gets more excited until it becomes obvious that promises can’t keep up with reality,” Hirniak says.

“Such a situation and lack of liquidity, combined with little regulation, made it ripe for market manipulation.”

In late 2017, excitement, hype and a crypto market frenzy created the perfect storm for an asset bubble. Many startups took advantage of the cryptocurrency boom to raise money via initial coin offerings, or ICOs. In 2017 and 2018, more than 800 ICOs raised roughly $20 billion in funding. The ICO space was plagued by outright frauds and scams, and the value of many of these ICO tokens collapsed within a year.

By the end of 2018, the bursting of the crypto bubble had dragged Bitcoin prices back down to less than $4,000 per coin.

The Future :

Blockchain technology is gaining global recognition among millions of traders and researchers. Moreover, the technology is not limited to crypto finances anymore. It’s been spreading its roots in several other domains as well. According to reports by Statista, worldwide expenditure on blockchain solutions will increase from $4.5B in 2020 to $19B in 2024.

In conclusion :

Investments come with greater responsibilities, blockchain being one of the most financed technologies, holds a lot of expectations. Moreover, as a witness to this trending advancement. Blockchain is believed to become a foundational technology for the upcoming Web 3.0 Internet. We expect to usher blockchain’s future prominence, challenges, and progress.